Gold Price Forecast: XAUUSD rebound appears elusive below $1,755, US NFP eyed – Confluence Detector

- Gold Price fades recovery from yearly low as traders await US employment numbers for June.

- Risk-aversion underpins US dollar even if policymakers talk down recession woes.

- XAU bulls battle key resistance area while bracing for a bumpy road to the north, supports seem weak.

Gold Price (XAUUSD) remains pressured towards the yearly low as geopolitical concerns join fears of global economic slowdown, despite the Fed policymakers’ efforts to tame recession woes. The risk-aversion wave also takes clues from the inverted yield curve between the 2-year and 10-year US Treasury yields. It’s worth noting, however, that chatters surrounding China’s $220 billion stimulus and the Sino-American trade peace put a floor under the gold prices. Also keeping the buyers hopeful are recently mixed US data and the latest gains in equities ahead of the Q2 2022 earnings season. That said, the metal’s further weakness hinges on the US Nonfarm Payrolls, expected post the lowest monthly increase in jobs since April last year.

Also read: US June Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

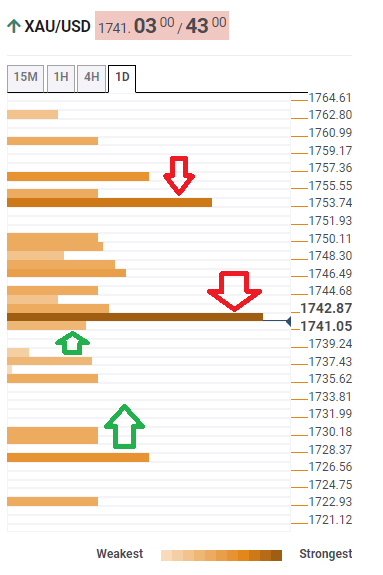

Gold Price: Key levels to watch

The Technical Confluence Detector shows that Gold Price pokes the key resistance near $1,743 comprising Fibonacci 61.8% one-day and SMA 5 and 10 on four-hour, as well as SMA 10 on the hourly play.

Following that, upper Bollinger Bank on one-hour and Fibonacci 23.6% one-day could test the bulls around $1,747.

In a case where the XAUUSD rises past $1,747, the monthly Pivot Point S2 near $1,754 will act as the last defense for bears.

Alternatively, the weekly Pivot Point S3 near $1,727 could lure the gold sellers if prices fail to defend the $1,740 round figure.

It’s worth noting that multiple small supports around $1,735 and $1,730 could also entertain XAUUSD bears.

Here is how it looks on the tool