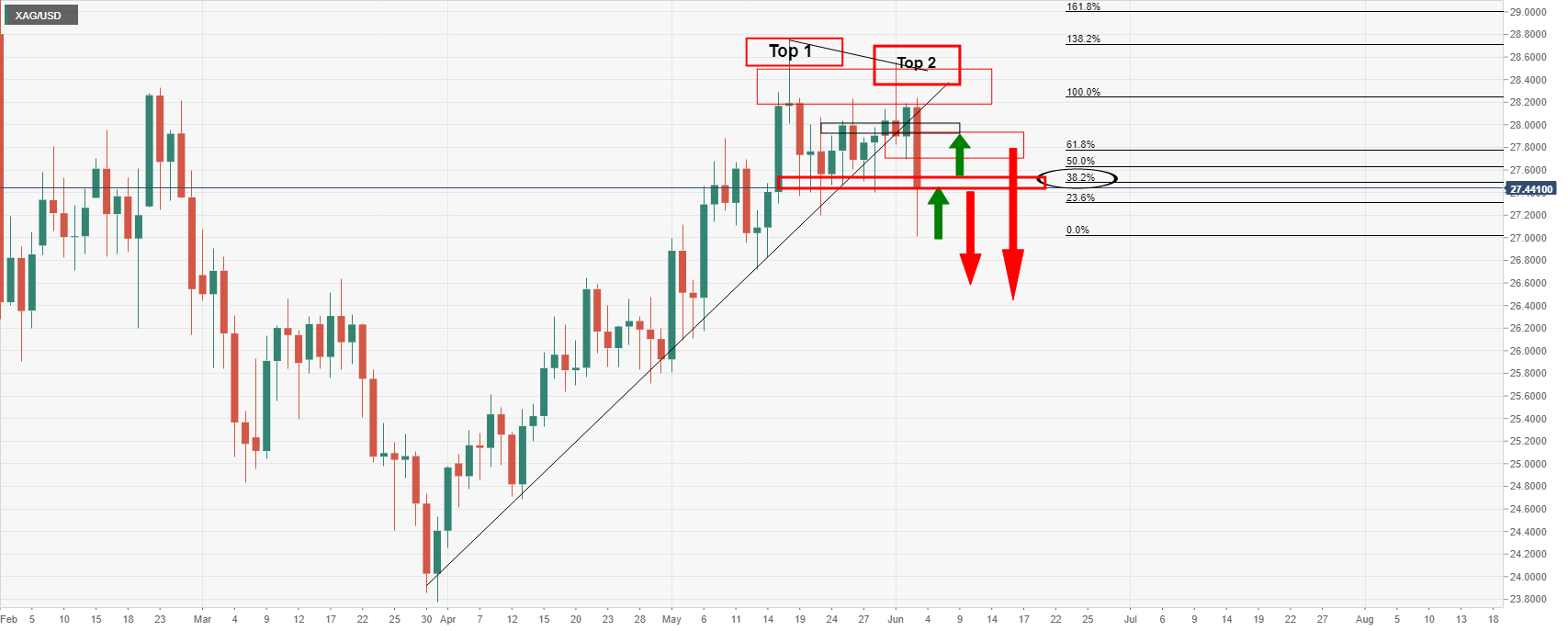

Silver Price Analysis: XAG/USD is correcting but could be headed for fresh low

- Silver is in the hands of the bears but the bulls are testing their commitments.

- A downside extension could come of failures to move beyond a 50% mean reversion of the hourly bearish impulse.

Silver made a double top on the daily chart and was unable to go for a third or break deeper into resistance nor crack it.

Instead, as a consequence, the focus shifted to the downside.

The price has broken the support structure and would now be expected to continue with a southerly trajectory for the medium term.

Daily chart

As illustrated, the price has broken horizontal support as well as the dynamic trendline support and melted into a secondary deeper area of daily support, bar the spike and wick towards 27.00.

The price has since corrected sharply to a 38.2% Fibonacci retracement of the bearish impulse and is consolidating there.

However, while a deeper retracement is highly probable to test the resistance of not only the counter-trendline but also the prior daily lows and support area, there are the prospects of a downside extension still for the forthcoming sessions

Hourly chart

As note don the hourly time frame, the correction has met prior hourly support that would be expected to now act as resistance given the confluence of the 50% mean reversion level of the bearish impulse.

A subsequent rejection could lead to a lower low.

15-min chart

From a 15-min vantage point, we can see that the price will need to break below the current support structure first which would be expected to act as resistance on a retest.