Back

7 Apr 2021

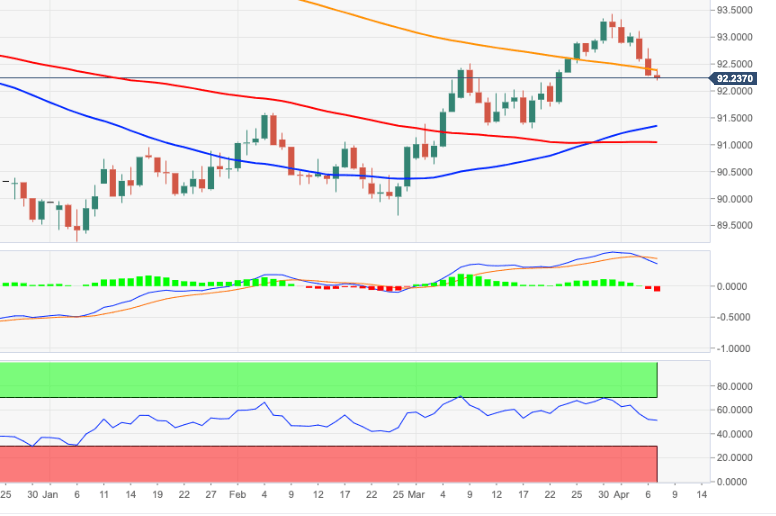

US Dollar Index Price Analysis: Extra losses could retest 91.30

- DXY remains offered and risks a deeper pullback near-term.

- There is an interim support a the 50-day SMA at 91.45.

The index remains on the defensive so far this week and threatens to break below the key 200-day SMA.

A sustainable drop below the latter should open the door to extra gains with the initial interim target at the 50-day SMA, today at 91.45.

Further south comes in the more relevant area around 91.30, where sit weekly lows recorded in mid-March.

Below the 200-day SMA the outlook for DXY is expected to return to the bearish side.

DXY daily chart