DXY bears stepping in at resistance

- US dollar bears are lurking and have eyes on a significant retracement.

- The Federal Reserve did not do enough to prevent the rates market to rally and the US dollar followed suit.

DXY is currently trading at 91.8620 with the price up some 0.46% having traded between a low of 91.3010 and a high of 91.9040.

The US dollar firmed overnight on rising US yields despite the dovish Federal Reserve.

We saw a high of 1.7540% in the 10-year Treasury yield.

These have been the highest levels in 13 months, following an initial run in London trade, climbing above 1.70% for the first time since Jan. 24, 2020.

There was then a follow-through at the start of New York trade before they started to drift lower into late Wall Street, dropping back to 1.7150% by the bell.

Nevertheless, this led to a sustained bid in the US dollar which was around 91.84 by the close as measured in the DXY index.

DXY climbed from a low of 91.3010 to a high of 91.9040 on the day.

Following Fed Powell’s remarks on Wednesday, the market expects a massive Treasury supply.

It is confirmed that the Fed will still need to see 'substantial further progress' before 'thinking about thinking' about a taper that doesn't bode well for investment flows into gold in the near-term.

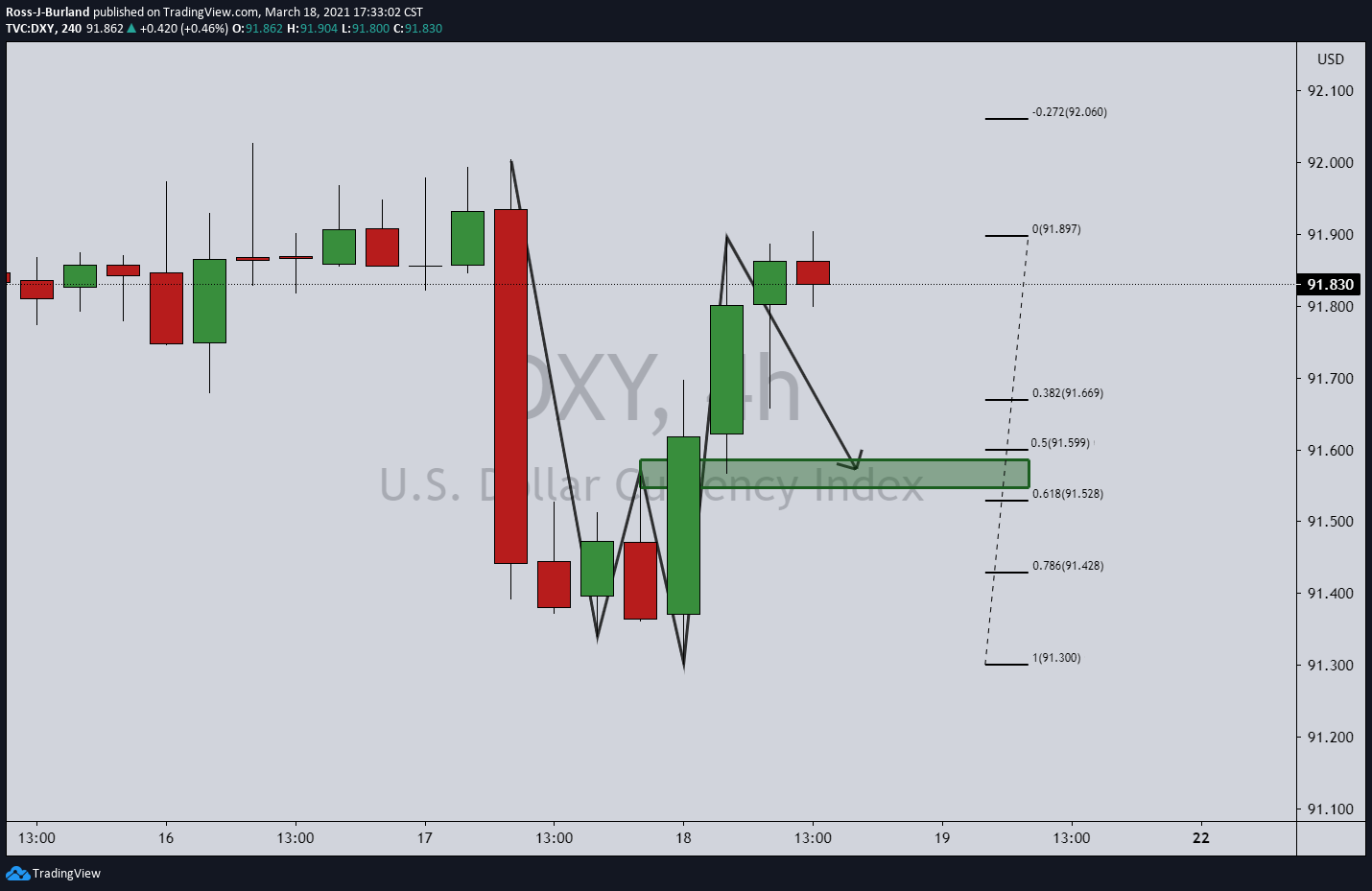

With that being said, the US dollar has come a long way without a correction and it has left a W-formation on the 4-hour chart.

Technical analysis, DXY 4-hour chart