AUD/USD Price Analysis: Recovers intraday losses, not out of the woods yet

- AUD/USD witnessed some intraday selling on Monday, albeit lacked any follow-through.

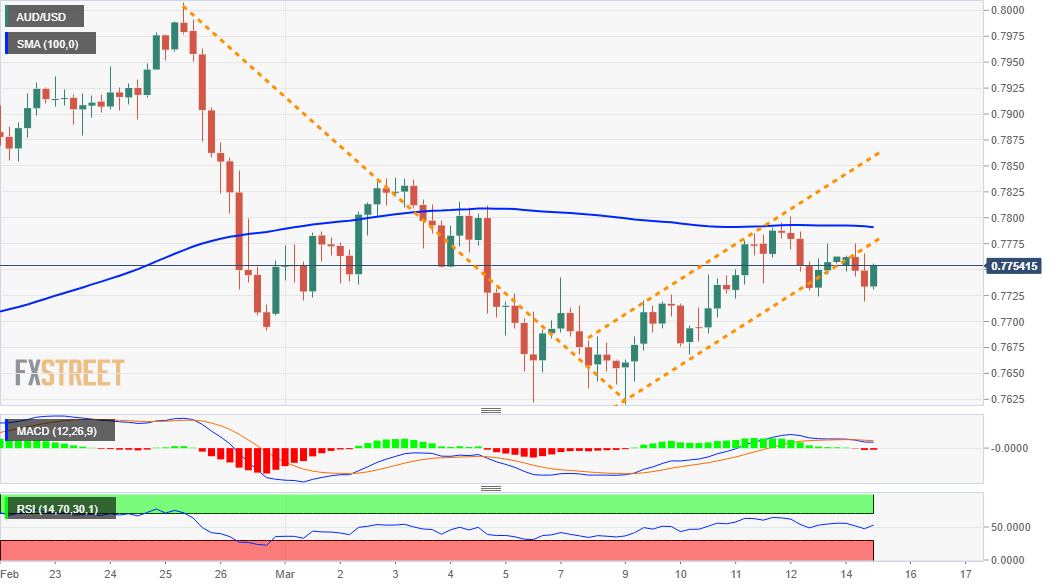

- Last week’s bearish break through the flag pattern supports prospects for further losses.

- Neutral oscillators on hourly/daily charts, the emergence of dip-buying warrants caution.

The AUD/USD pair struggled to capitalize on its early uptick, instead met with some fresh supply near the 0.7775 region and turned negative for the second straight session on Monday.

A pickup in the US dollar demand was seen as one of the key factors that exerted some downward pressure on the AUD/USD pair. However, a softer tone surrounding the US Treasury bond yields, along with the prevalent risk-on mood capped gains for the safe-haven USD and helped limit further losses.

Looking at the technical picture, the AUD/USD pair last week broke below a short-term ascending trend-channel, which constituted the formation of a bearish flag chart pattern. That said, the lack of any follow-through selling warrants some caution before positioning for any further downfall.

The AUD/USD pair has been finding decent support near the 0.7725-20 region, which should now act as a key pivotal point for short-term traders. Sustained weakness below will reaffirm the flag pattern breakdown and set the stage for the resumption of the corrective slide from multi-year tops.

Meanwhile, neutral technical indicators on hourly/daily charts haven't been supportive of any firm near-term direction. This further warrants some caution for aggressive traders and makes it prudent to wait for some follow-through weakness below the 0.7725-20 support to confirm a bearish bias.

Below the mentioned support, the AUD/USD might turn vulnerable to weaken further below the 0.7700 mark and accelerate the fall towards the recent daily closing lows, around the 0.7645 region. The downward trajectory could further get extended and drag the pair towards the 0.7600 mark.

On the flip side, immediate resistance is pegged near Friday's swing highs, around the 0.7800 round-figure. This is followed by a strong barrier near the 0.7835-40 supply zone, which if cleared decisively will negate any near-term bearish bias and prompt some near-term short-covering move.

The AUD/USD pair might then aim back to reclaim the 0.7900 mark before eventually darting towards the 0.7965-70 intermediate resistance en-route the key 0.8000 psychological mark.

AUD/USD 4-hourly chart

Technical levels to watch