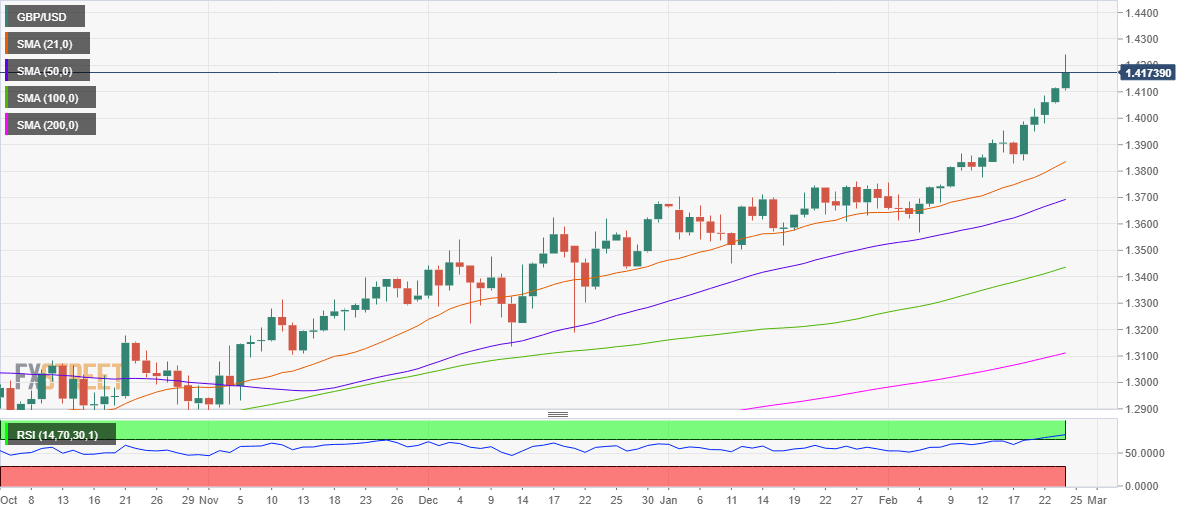

GBP/USD Price Analysis: Overbought RSI conditions warrant caution for bulls

- GBP/USD consolidates the spike to multi-month tops of 1.4234.

- Overbought conditions on daily RSI are a cause for concern.

- The cable could correct before resuming the uptrend towards 1.43.

GBP/USD is consolidating the vertical rise to 35-month highs of 1.4234, as the bulls are lacking follow though impetus after failing to recapture the 1.4200 level.

At the press time, the cable trades at 1.4175, adding 0.49% on the day. The spot moves away from the higher levels despite the renewed weakness in the US dollar across the board.

Therefore, the cautious tone seen around the major could be mainly attributed to the overbought conditions on the Relative Strength Index (RSI), given the daily timeframe.

The bulls are now contemplating the next move, with the 1.4300 level still on sight. Although a correction could be in the offing before the cable takes a flight once again northwards.

To the downside, the bears have to beat the daily lows of 1.4106, in order to extend the corrective downside.

GBP/USD: Daily chart

GBP/USD: Additional levels