Back

7 Dec 2020

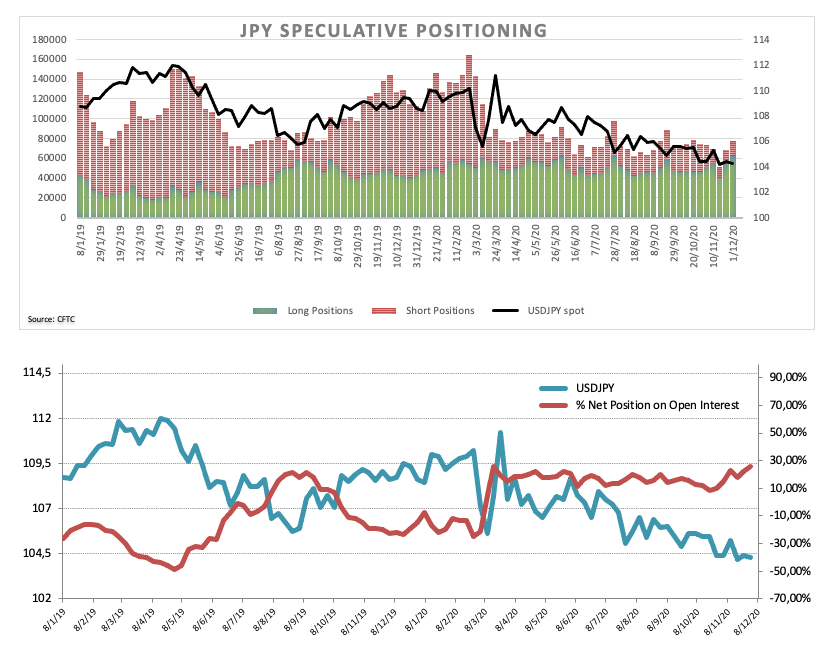

CFTC Positioning Report: JPY net longs in multi-year highs

These are the main highlights of the CFTC Positioning Report for the week ended on December 1st:

- EUR net longs reversed the recent downtrend and climbed to 4-week highs on the back of the sharp improvement in the risk-associated galaxy and the persistent weakness surrounding the buck. This week’s salient event in the EUR-universe will be the ECB meeting, with consensus expecting not only a dovish tone but also extra monetary stimulus.

- Net shorts in USD rose to levels last seen in late September as outflows from the safe haven intensified in response to vaccine hopes and rising likelihood of extra stimulus under the Biden’s administration.

- JPY net longs increased to levels last visited in early October 2016, as repatriation flows could gather further traction and sustain the interest for the yen, all against the backdrop of depressed interest rates across the world.

- Speculators trimmed the net shorts in the British pound to 5-week lows amidst auspicious headlines from the Brexit negotiations and ahead of the planned vaccination campaign starting this week.