S&P 500 Futures: Key levels to watch amid US stimulus talks, ahead of Fed – Confluence Detector

Having faced rejection once again at 3,250 levels, S&P 500 futures have entered a phase of consolidation above 3,200, awaiting fresh impetus from the US stimulus talks, sentiment on the global stocks and the Fed decision. Technicals suggest that it will likely be an uphill task for the bulls in the day ahead.

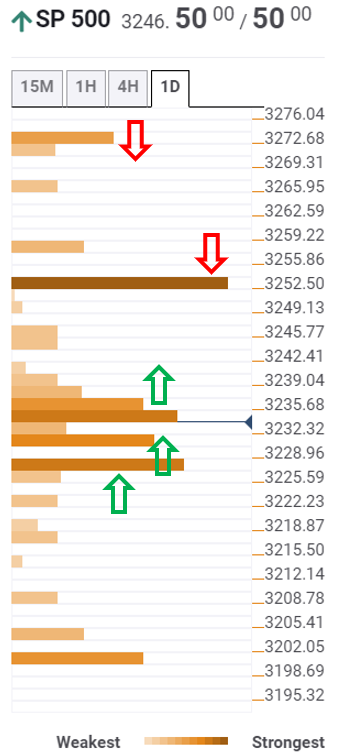

S&P 500 Futures: Key resistances and supports

The Technical Confluences Indicator shows that the S&P 500 futures face stiff resistance at 3,255, where the pivot point one-day R2, previous year high and Bollinger Band four-hour Middle coincide.

Further out, the next barrier is seen at 3,258, the Fibonacci 38.2% one-week resistance. The bulls will likely face a couple of minor hurdle en route the upside target at 3,272. That level is the pivot point one-week R1.

To the downside, the cluster of supports is placed around 3,235, the convergence of the previous month high, Fibonacci 23.6% one-day and Fibonacci 61.8% one-week.

Following a break below the latter, the support at 3,228 will be tested, which is the confluence of SMA10 one-day and Fibonacci 38.2% one-day.

Powerful support at 3,225 will likely challenge the bears’ commitment.

S&P 500 Chart

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence