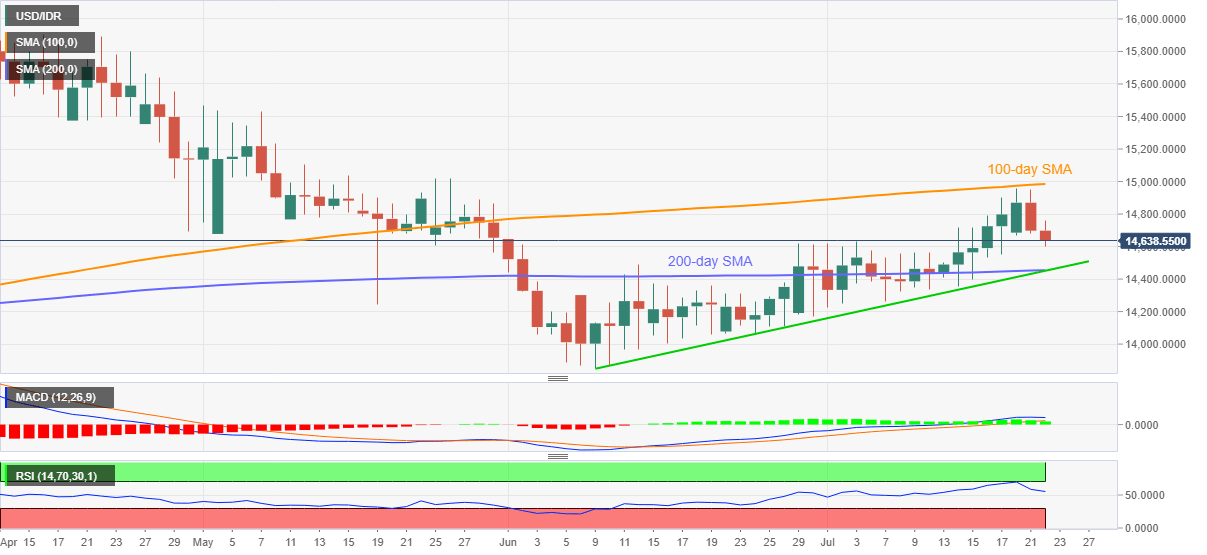

USD/IDR Price News: Indonesian rupiah buyers cheer pullback from 100-day SMA

- USD/IDR stays depressed despite bouncing off 14,597.55.

- Pullback in oversold RSI suggests further weakness to the key support confluence.

- Bulls will have 15,000 threshold as additional upside barrier.

USD/IDR prints 0.45% loss while trading around 14,630/35 during the pre-European session on Wednesday. In doing so, the pair extends its U-turn from 100-day SMA.

Considering the RSI’s U-turn from overbought conditions, the pair bears are currently targeting 14,455/50 support confluence including 200-day SMA and an upward sloping trend line from June 09. During the fall, 14,600 might offer intermediate support to the quote.

In a case where the sellers keep dominating past-14,450, 14,200 and 14,000 may lure the pessimists ahead of highlighting June month’s bottom close to 13,850.

Alternatively, a daily closing past-14,985, comprising 100-day SMA, will recall 15,000 mark on the chart. Though, any further upside won’t hesitate to question the May month’s peak of 15,470.

USD/IDR daily chart

Trend: Further weakness likely