US inflation-adjusted bond yields wave red flag on economy

- The US inflation-linked yields slide, indicating an uncertain economic outlook.

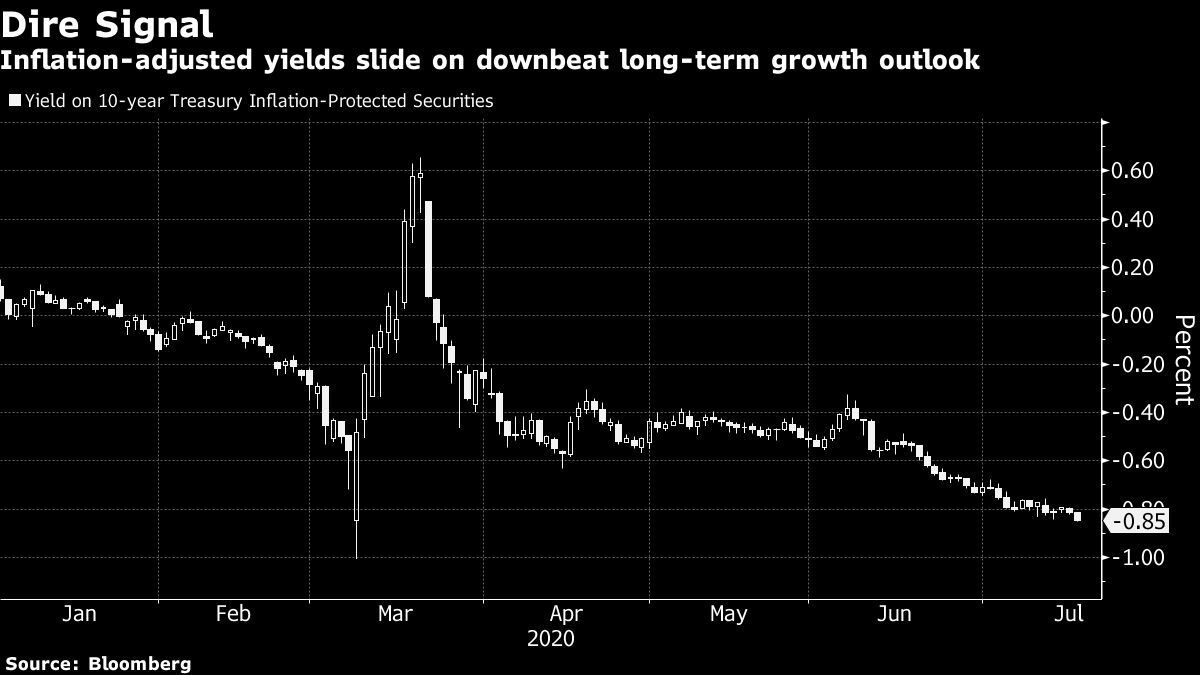

- The 10-year real yield has been on a declining trend since early June.

The US 10-year real or inflation-adjusted bond yield has declined for the past six weeks and now hovers near -0.85%, according to Bloomberg.

The fall in real yield, which is considered one of the most reliable indicators of growth since it strips out inflation, indicates a challenging growth environment ahead. And yet that is not the only cause for concern for investors.

The increased demand for gold, a safe haven asset, could also be considered a sign of uncertainties ahead. The yellow metal is currently trading at $1,808 per ounce, representing a 19% gain on a year-to-date basis, having clocked a near 9-year high of $1,818 on July 8. Gold usually performs well in a negative real yield environment.

The US government is scheduled to sell $14 billion worth of 10-year treasury inflation-protected securities or inflation-linked debt on Thursday. The auction would reveal just how bullish investors are on inflation’s upward trajectory, a Bloomberg report said.