When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The British economic calendar will entertain the global traders amid recently sluggish markets at 06:00 GMT with the GDP figures for May. Also increasing the importance of that time are May month Trade Balance and Industrial Production details.

The United Kingdom GDP is expected to reverse the previous contraction of -20.4% with a +5.0% MoM mark in May while the Index of Services (3M/3M) for the same period was last seen lower to -9.9%.

Meanwhile, the Manufacturing Production, which makes up around 80% of total industrial production, is expected to expected to recover from -24.3% to -20.9% in May. Further, the total Industrial Production could also please the pound bulls with +6.0% MoM for May as compared to the previous reading of -20.3%.

Considering the yearly fact, the Industrial Production for April is expected to have dropped by 20.0% versus -24.4% previous while the Manufacturing Production is also anticipated to have declined by 23.9% in the reported month versus -28.5% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £8.2 billion versus a £7.49 billion deficit reported in April.

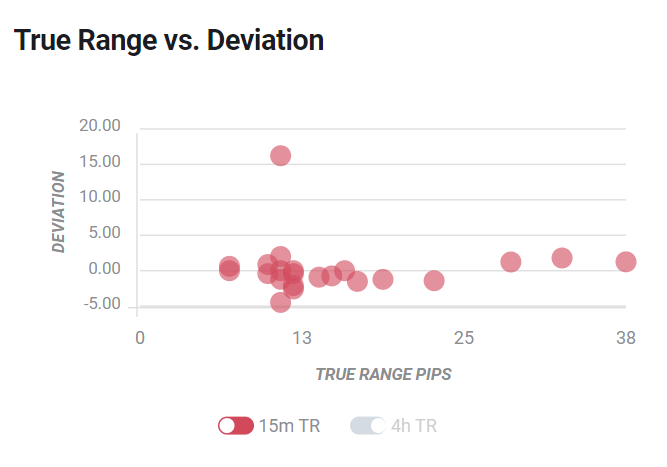

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD stays pressured around 1.2550 after flashing the biggest losses in two weeks the previous day. Further, the Cable battles near a four-day low as the recent recoveries in the US dollar gains additional support from no press in Brexit talks and speculations of negative rates.

With the quote’s sustained trading below a two-week-old support line, sellers remain hopeful of witnessing 1.2500 support during the further weakness. However, a 200-HMA level of 1.2545 challenges the bears amid oversold RSI conditions. As a result, traders should wait for a clear bounce beyond 1.2600 to build a fresh buying position until then the quote becomes liable to revisit 1.2500 psychological magnet.

Though, anticipated recoveries in the key macroeconomic data from the UK suggest the pair’s intermediate pullback on the upbeat outcome. The moves could also take clues from British Chancellor Rishi Sunak’s efforts to fuel the economy as well as the UK’s efforts to tame the coronavirus (COVID-19). Even so, broad pessimism surrounding Brexit and the latest tussle with China could keep the buyers under check.

Key notes

GBP/USD Forecast: Pound weakens despite limited dollar’s demand

GBP/USD Price Analysis: 200-HMA probes break of two-week-old trendline under 1.2600

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.