EUR/CHF Price Analysis: Bears set to test 1.0590 key support

- EUR/CHF looks to test key support on the 4H chart.

- Technical set up suggests the gains will be short-lived.

- Upside attempts appear capped near 1.0635.

EUR/CHF is holding lower ground just above the 1.0600 level heading into the European open, with risks tilted to the downside in the near-term, as suggested by the technical set up.

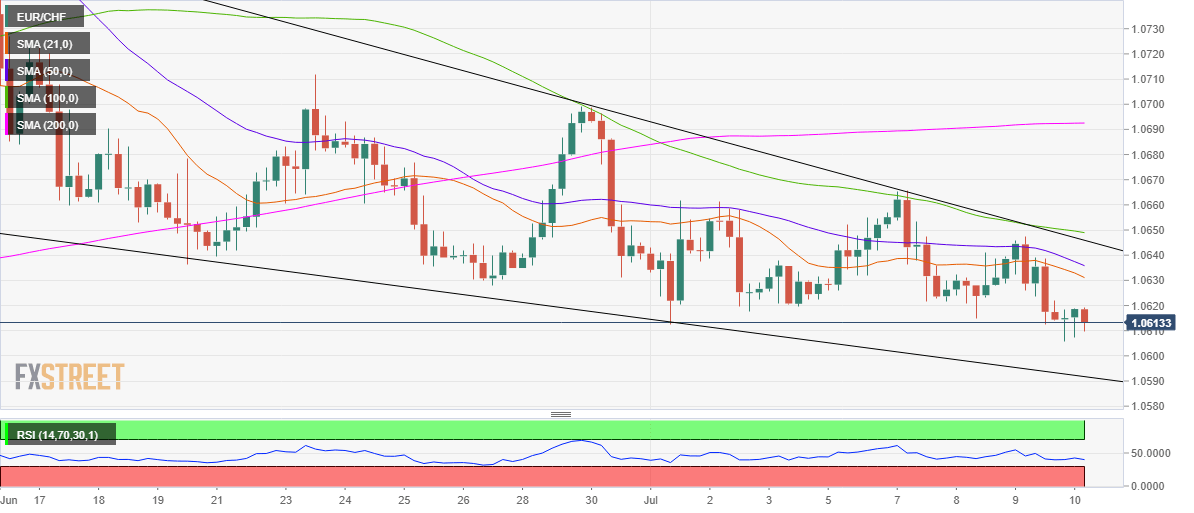

On the four-hour (4H) chart, the cross remains set to challenge the key falling trendline support at 1.0591 in the near-term, as it wavers in a month-long falling wedge formation.

The Relative Strength Index (RSI) on 4H points downwards while lying below the 50.00 level, in the bearish territory. This indicator further indicates a return of the sellers.

The price could, however, manage to defend the powerful support and bounce back towards a healthy resistance zone around 1.0635, where the 21 and 50-4H Simple Moving Averages (SMA) intersect.

Further north, 1.0650 (falling trendline resistance/ 100-4H SMA) will challenge the bull’s commitment and acceptance above the latter will validate the pattern, calling for an extensive rally towards the 200-4H SMA at 1.0692.

EUR/CHF 4-hour chart

EUR/CHF additional levels