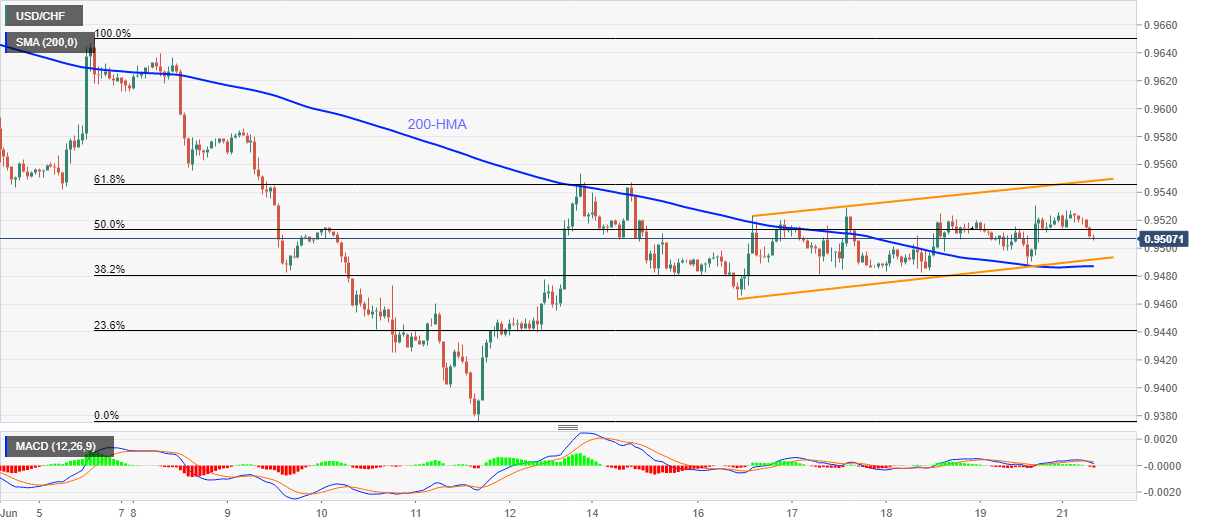

USD/CHF Price Analysis: Mildly heavy inside short-term rising channel above 200-HMA

- USD/CHF bears attack 0.9500 following the pullback from 0.9530.

- A four-day-old ascending trend channel, 200-HMA guards immediate downside.

- 61.8% Fibonacci retracement adds to the upside barriers.

USD/CHF refreshes the intraday low to 0.9506 while heading into the European open on Monday. Even so, the pair stays inside an immediate upward sloping channel formation above 200-HMA.

While bearish MACD suggests the pairs’ further weakness towards the channel’s support line of 0.9490, near to 200-HMA level of 0.9485, its additional downside becomes less likely.

In a case where the sellers dominate past-0.9485, the previous week’s low near 0.9465 might offer an intermediate halt during the fall towards 0.9400 round-figure and then to the monthly low near 0.9375.

Alternatively, an upside clearance of 0.9530 will not only have to cross 61.8% Fibonacci retracement of June 05-11 fall, at 0.9545 but also need to rise past the said channel’s resistance line, currently around 0.9550 to please the buyers.

In doing so, the quote might catch a breather near June 12 top close to 0.9555, beyond that 0.9585 and 0.9615 will be on the bulls’ radars.

USD/CHF hourly chart

Trend: Further weakness expected