S&P 500: Tactfully bearish, four key reasons – Bank of America

Bank of America analysts, said in a note on Friday, they have turned ‘tactically bearish' on stocks after the rally in the S&P 500 index, citing the four key reasons.

“Real risk of a second wave of infections in South Korea and in the US cases still rising outside of New York.

Investors are flying blind with more than 30% of S&P 500 companies withdrawing earnings guidance.

The ratio of positive vs. negative sentiment on corporate earnings calls is the worst since 2012.

The disconnect between the economy and equity markets.

S&P 500 +30%, more than 36 million Americans lost jobs.

Will fuel a rise in populist politics ahead of the US November election.

The biggest risk is Congress being too slow to pass the additional stimulus.

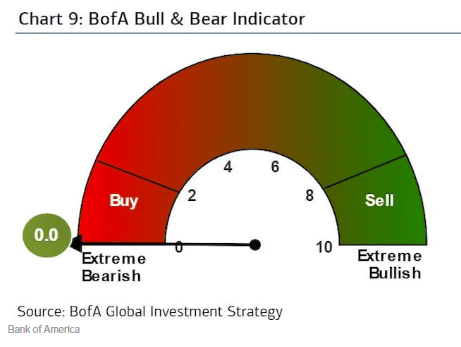

One reason to remain bullish though, the sentiment is at an extreme bear reading, which is a tactically bull signal.”