Back

30 Apr 2020

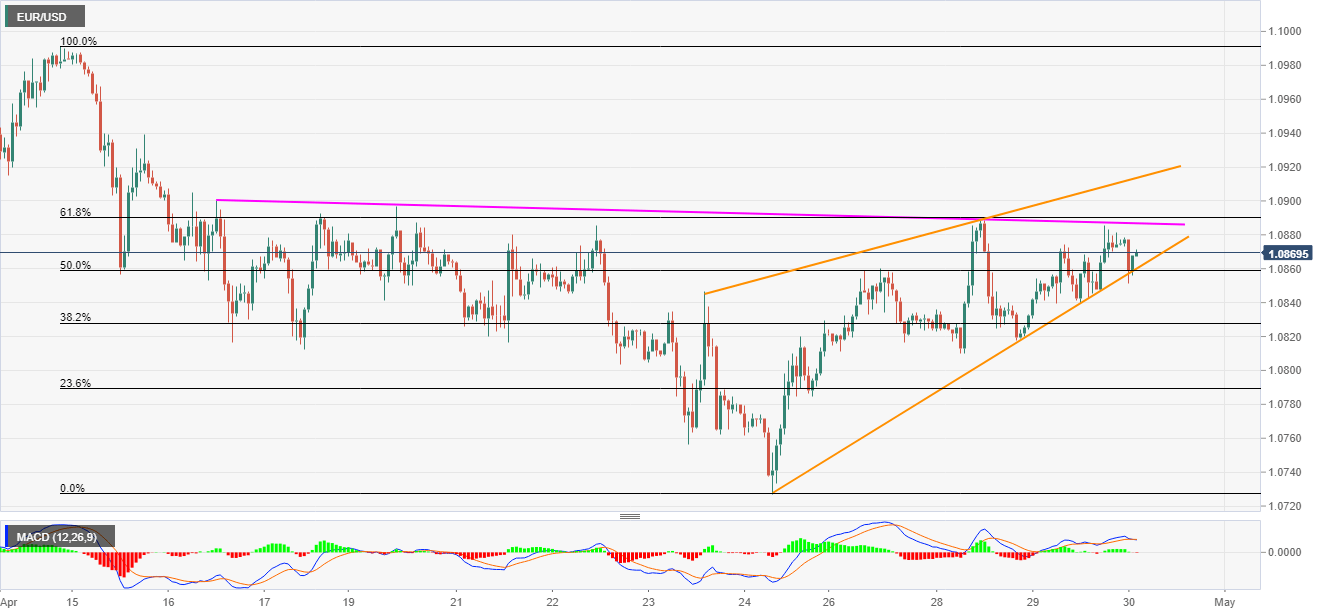

EUR/USD Price Analysis: Defies short-term rising wedge confirmation, but still below 1.0900

- EUR/USD fails to extend the downtick below the short-term support line.

- A fortnight-old resistance trend line, 61.8% Fibonacci retracement can question the pullback moves.

- 1.0800 and 1.0760 can offer intermediate halts during the pair’s fresh declines.

EUR/USD trims early-Asia losses with the latest bounces propelling the quote to 1.0870 during the initial trading on Thursday. In doing so, the pair defies the confirmation of the short-term rising wedge bearish chart pattern.

However, a downward sloping trend line since April 16, 2020, as well as 61.8% Fibonacci retracement of April 14-24 declines, around 1.0885/90, restricts the pair’s upside momentum.

Other than that, the bearish formation’s resistance line, near 1.0915, also add upside barriers to the quote’s recovery moves.

Meanwhile, the pair’s sustained break below 1.0860 support may avail 1.0800 and 1.0760 as buffers during the south-run targeting the latest low close to 1.0725.

EUR/USD hourly chart

Trend: Pullback expected