Back

30 Apr 2020

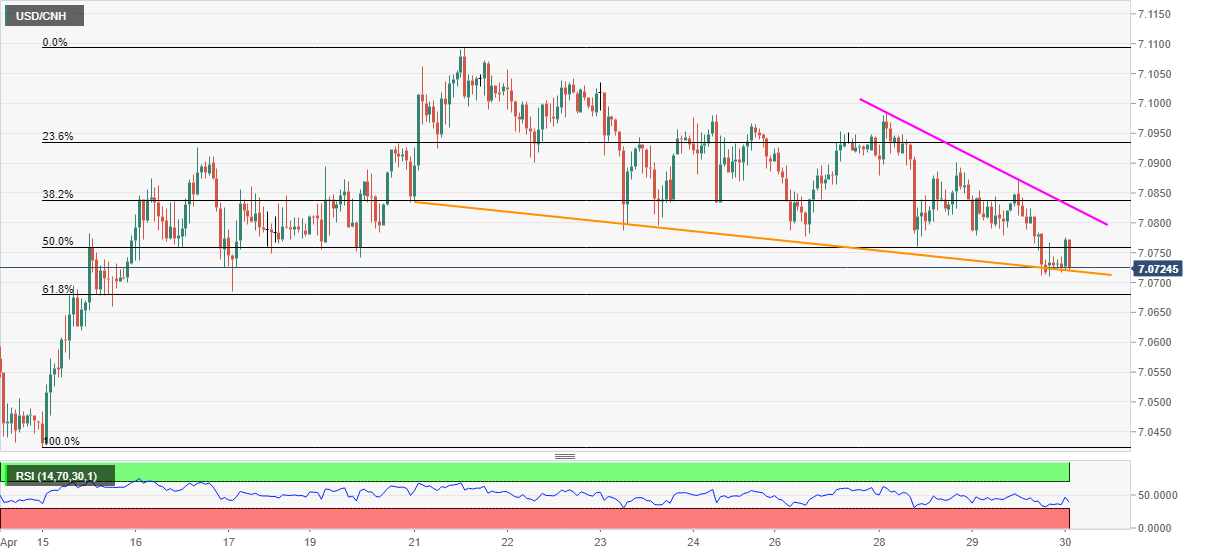

USD/CNH Price Analysis: Bounces off short-term support-line on China PMI

- USD/CNH pulls back from the eight-day-old support trend line.

- China’s April month official Manufacturing PMI slipped below forecasts.

- Two-day-old resistance line in focus.

- 61.8% Fibonacci retracement adds to the support.

With weaker than anticipated China Manufacturing PMI, USD/CNH bounces off immediate support line to currently around 7.0731 during the early Thursday.

China’s Manufacturing PMI slipped below 51.00 market consensus to 50.80, versus 52.00 prior.

Read: China official PMI for April Manufacturing 50.8 (expected 51.0)

Should the pair manage to sustained bounce, a two-day-old falling trend line near 7.0830 will be challenging the bulls ahead of the weekly top near 7.0985.

On the contrary, a downside break of the said support line, at 7.0720, will have to slip below 61.8% Fibonacci retracement of April 14-21 upside, around 7.0680, to revisit sub-7.0600 area.

USD/CNH hourly chart

Trend: Pullback expected