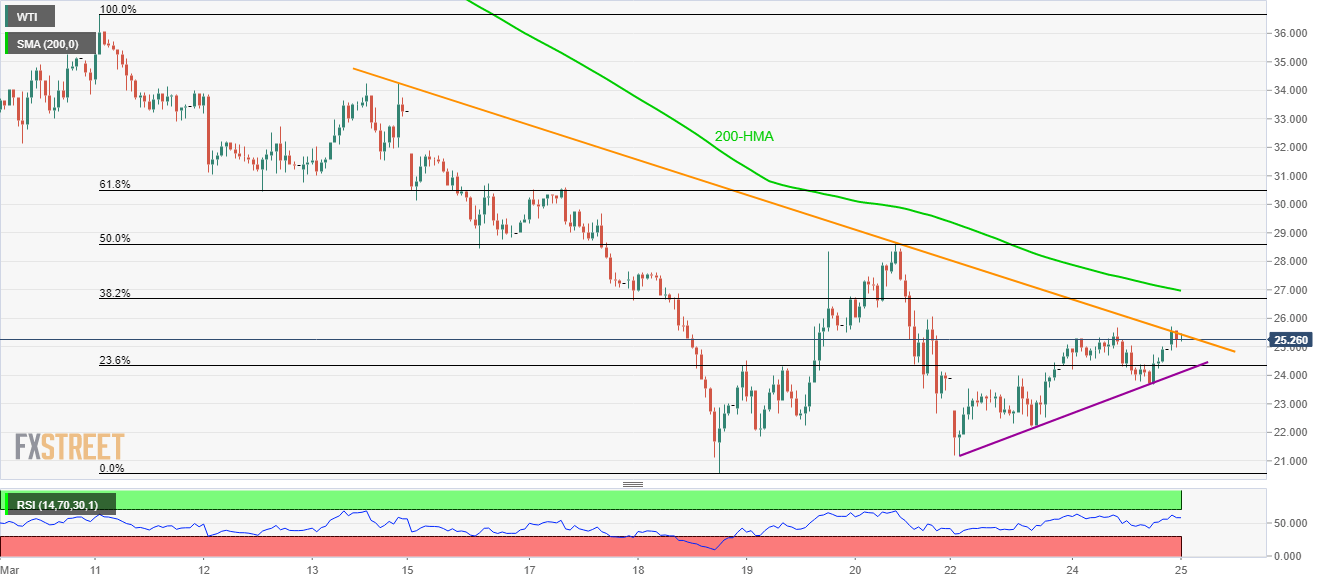

WTI Price Analysis: Short-term falling trendline, 200-HMA cap immediate upside above $25.00

- WTI probes an eight-day-old falling trend line during the recent recovery.

- The weekly rising support line limits the immediate declines.

- Buyers remain cautious ahead of breaking 50% Fibonacci retracement.

WTI holds onto recovery gains while taking the bids to $25.28, up 1.5%, by the press time of Wednesday’s Asian session.

In doing so, the black gold confronts a short-term descending resistance line, currently at $25.45.

Given normal RSI conditions and a higher low formation on the daily chart, the energy benchmark is expected to register additional upside, towards 200-HMA level of $27.00, after breaking the trend line barrier.

However, buyers will remain cautious unless manage to break 50% Fibonacci retracement of March 11-18 declines near $28.60.

On the downside, 23.6% Fibonacci retracement level of $24.30 and a weekly rising trend line, at $24.10 now, could limit the quote’s immediate declines.

Should oil prices remain weak below $24.10, also break $24.00, bears targeting a sub-$20.00 mark can re-enter.

WTI hourly chart

Trend: Recovery expected