Copper Futures: Still waiting for the bounce

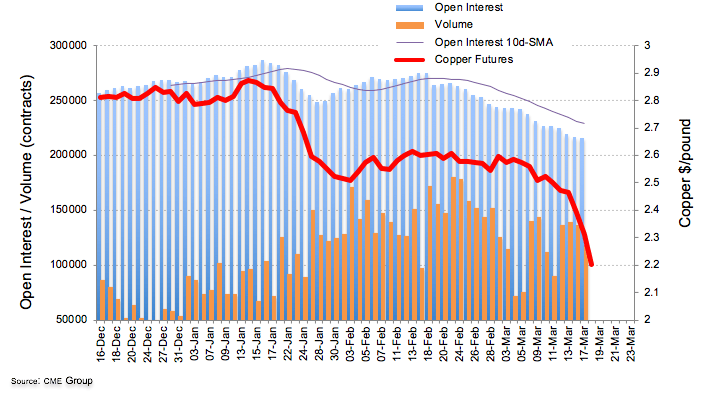

Open interest in Copper futures markets kept declining on Tuesday, this time by nearly 700 contracts. It is worth mentioning that open interest has been declining since March 5tha. On the other hand, volume dropped by the second session in a row, this time by around 18.5K contracts.

Copper: Chinese data weigh on sentiment

Prices of the base metal continued to retreat on Tuesday and are now trading in levels last seen in October 2016 in the sub-$2.20 area per pound. Shrinking open interest and volume amidst the ongoing decline in prices keep the door open to the probability of a reversion of the sharp downtrend for the time being. However, the latest poor data releases in China does not bode well for GDP figures and are in turn weighing heavily on copper prices and traders’ sentiment. It is worth recalling that more than half of the world production of copper goes to China and the base metal is widely utilized in the global production.