Indian Rupee Price News and Forecast: USD/INR firmer amid trade optimism

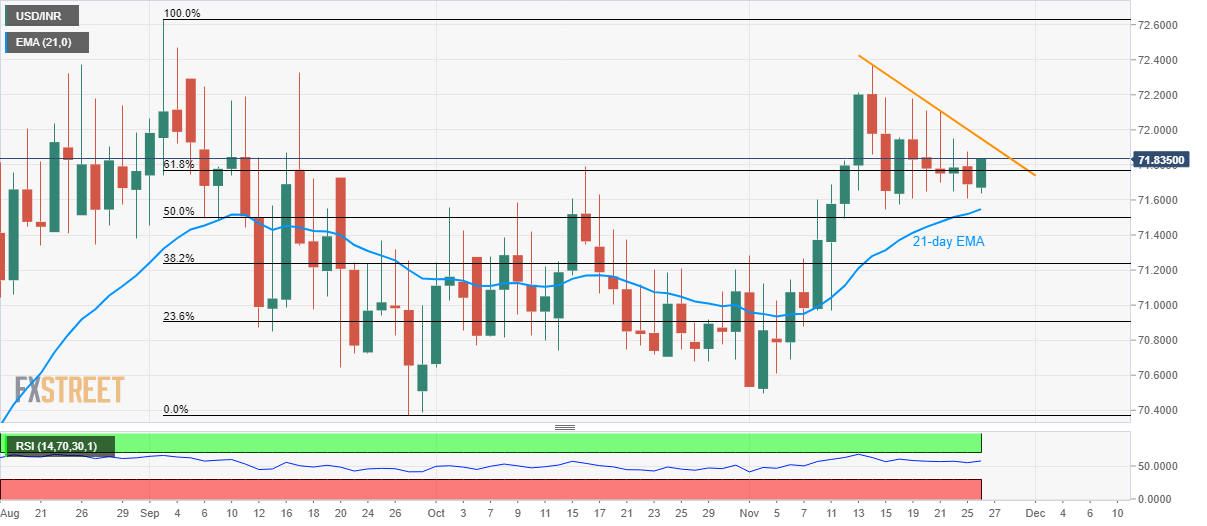

USD/INR Technical Analysis: Seesaws between 8-day-old resistance trendline, 21-day EMA

USD/INR takes the bids to 71.84, also crossing the 61.8% Fibonacci retracement of September month downpour, during early Tuesday’s Asian session. Even so, the quote stays between an eight-day-old falling resistance line and a 21-day Exponential Moving Average (EMA).

However, upbeat conditions of the 14-bar Relative Strength Index (RSI) indicate the underlying strength of the momentum, which in turn increases the odds of pair’s rise to the monthly top near 72.37 on the break of 71.95 trend line resistance. Read more…

USD/INR: Rupee opens firmer amid trade optimism, RBI rate cut calls

The USD/INR pair is seen on the back foot near four-day lows of 71.609, starting out this Tuesday’s business, as the rupee benefits from the rise in its Chinese peers on fresh trade talks momentum. Both US and Chinese top trade negotiators held a phone call earlier today and reached a trade consensus on resolving the issues.

Moreover, the strength in the rupee can be attributed to rising hopes of fresh stimulus from the Indian government to counter a slowdown in the economy. According to a report in The Economic Times, the Prime Minister's Office (PMO) and the finance ministry are actively contemplating a one-time loan recast for real estate developers and have sought the view of the Reserve Bank of India (RBI) on the matter, per Reuters. Read more...