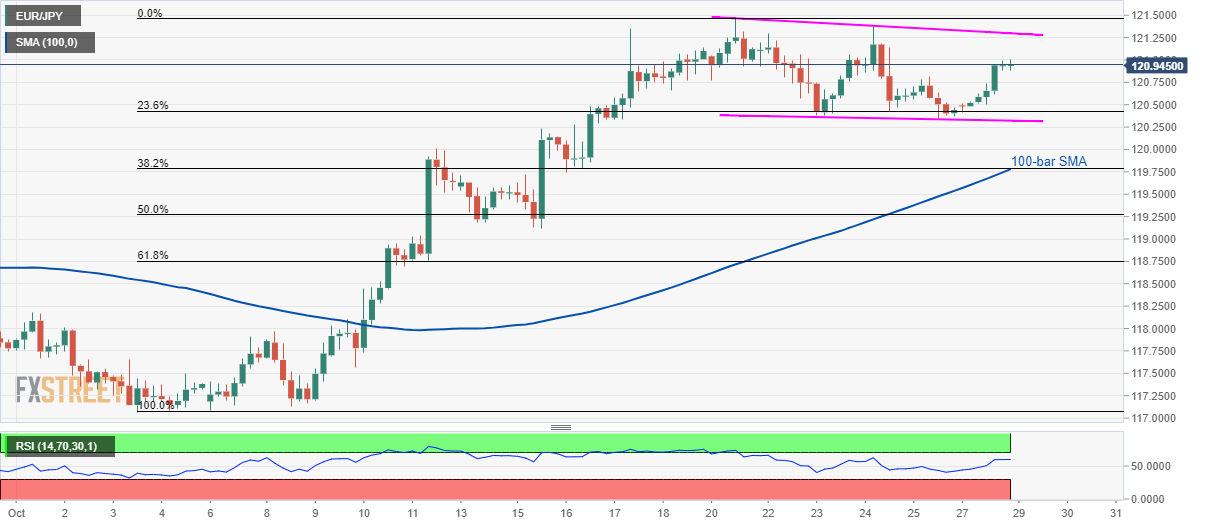

EUR/JPY technical analysis: 1-week-old falling channel questions further recovery

- Following its bounce off 23.6% Fibonacci retracement, EUR/JPY traders near three days high.

- 38.2% Fibonacci retracement and 100-bar SMA portrays 119.78/80 as near-term key support-confluence.

Despite rising to multi-day high, the EUR/JPY pair’s further recovery is questionable considering the nearness to short-term resistance. The quote takes the bids to 120.95 by the press time of early Asian morning on Tuesday.

Among the challenges to the pair’s additional upside, the resistance line of a week-long falling trend channel, at 121.30 now, will appear first to question buyers.

Should prices rally beyond the same, a monthly top near 121.50 could offer an intermediate halt during the rise towards 122.00 and July 10 high of 122.34.

Meanwhile, 120.80 can be considered as immediate support to watch during the pair’s pullback ahead of observing the lower-line of a short-term falling channel, at 120.32.

In a case where sellers sneak in around 120.30, 38.2% Fibonacci retracement of current month upside and 100-bar Simple Moving Average (SMA) could restrict near-term declines around 119.80/78.

EUR/JPY 4-hour chart

Trend: pullback expected