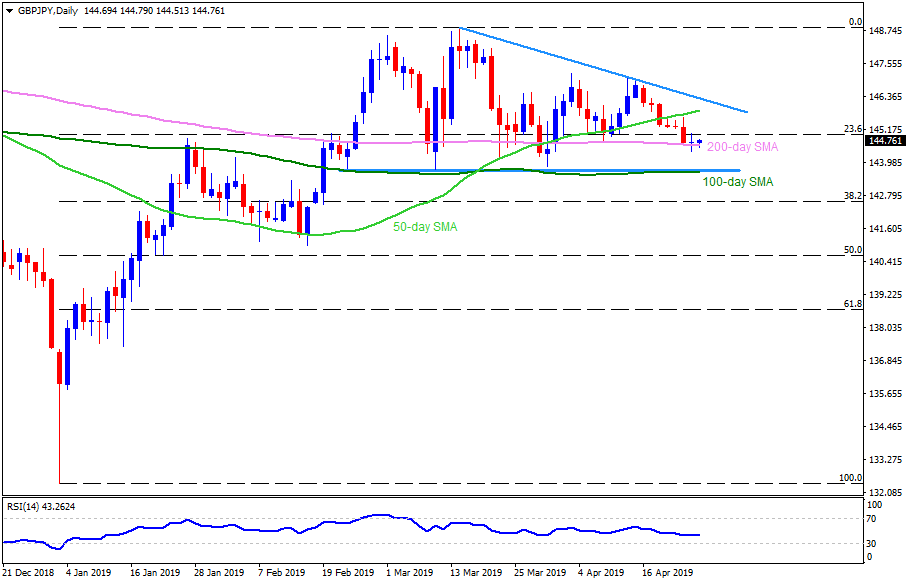

GBP/JPY Technical Analysis: 200-day SMA triggers pullback, 143.80/70 seems major support

Having bounced off 200-day simple moving average (SMA), the GBP/JPY pair is on the bids around 144.80.

Considering the strength of support, chances of the quote pullback to 145.20 and then to 50-day SMA level of 145.85 seem brighter.

However, a downward sloping trend-line from mid-March could challenge the follow-on buyers near 146.30.

In a case where prices manage to conquer 146.30 upside barrier on a daily closing basis, 147.00, 147.40 and 148.45/50 are likely intermediate halts during the run to March high near 148.85.

Meanwhile, a D1 close under 144.55 number comprising 200-day SMA may immediately take the pair to 144.00 but 143.80/70 area including 100-day SMA and multiple lows since February 22 could challenge sellers then after.

If at all Bears refrain from respecting 143.70, 38.2% Fibonacci retracement of January – March upside at 142.50 and 140.90 can become their favorites.

GBP/JPY daily chart

Trend: Pullback expected