Back

13 Feb 2019

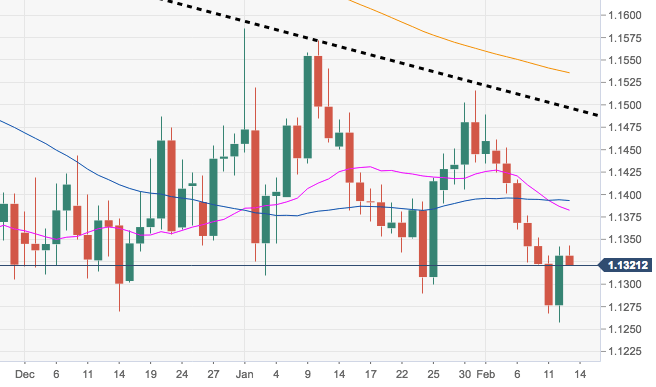

EUR/USD Technical Analysis: Further decline expected to test 2018 low at 1.1215

- EUR/USD managed to gather some traction following yesterday’s YTD lows in the 1.1260/55 band, retaking the 1.1300 handle and above although losing vigour in the boundaries of 1.1340 so far.

- This area of resistance is also reinforced by the critical 200-week SMA in the 1.1330 region.

- A more serious bullish attempt should retake the 100-day SMA at 1.1416, while the short-term resistance line at 1.1496 emerges as the next relevant hurdle.

EUR/USD daily chart

EUR/USD

Overview:

Today Last Price: 1.132

Today Daily change: 28 pips

Today Daily change %: -0.11%

Today Daily Open: 1.1332

Trends:

Daily SMA20: 1.1386

Daily SMA50: 1.1398

Daily SMA100: 1.1416

Daily SMA200: 1.1538

Levels:

Previous Daily High: 1.1342

Previous Daily Low: 1.1258

Previous Weekly High: 1.1462

Previous Weekly Low: 1.132

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1309

Daily Fibonacci 61.8%: 1.129

Daily Pivot Point S1: 1.1279

Daily Pivot Point S2: 1.1226

Daily Pivot Point S3: 1.1195

Daily Pivot Point R1: 1.1363

Daily Pivot Point R2: 1.1394

Daily Pivot Point R3: 1.1447