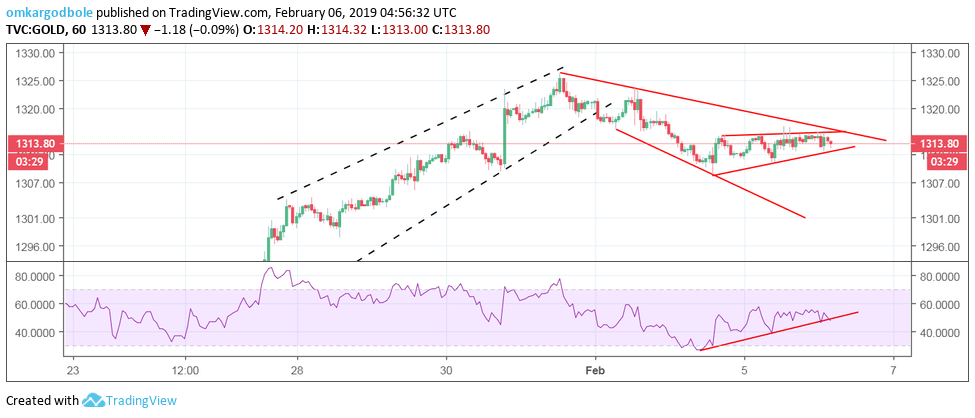

Gold Technical Analysis: trapped in an expanding falling channel in the hourly chart

Gold is currently trading in a sideways manner within an expanding falling channel, as seen in the chart below.

Hourly chart

- The relative strength index (RSI) has dived out of the ascending trendline. So, the metal could take out the lower edge of the minor sideways channel, currently at $1,312. That would open up downside toward $1,308-$1,305.

- A break above the falling channel hurdle at $1,316 would imply an end of the corrective pullback and could yield a rally to levels above $1,320.

Trend: bearish below $1,312

XAU/USD

Overview:

Today Last Price: 1313.5

Today Daily change: -1.76 pips

Today Daily change %: -0.13%

Today Daily Open: 1315.26

Trends:

Daily SMA20: 1296.91

Daily SMA50: 1272.58

Daily SMA100: 1245.75

Daily SMA200: 1230.24

Levels:

Previous Daily High: 1316.85

Previous Daily Low: 1310.1

Previous Weekly High: 1326.25

Previous Weekly Low: 1297.8

Previous Monthly High: 1326.25

Previous Monthly Low: 1275.9

Daily Fibonacci 38.2%: 1314.27

Daily Fibonacci 61.8%: 1312.68

Daily Pivot Point S1: 1311.29

Daily Pivot Point S2: 1307.32

Daily Pivot Point S3: 1304.54

Daily Pivot Point R1: 1318.04

Daily Pivot Point R2: 1320.82

Daily Pivot Point R3: 1324.79