Back

9 Nov 2018

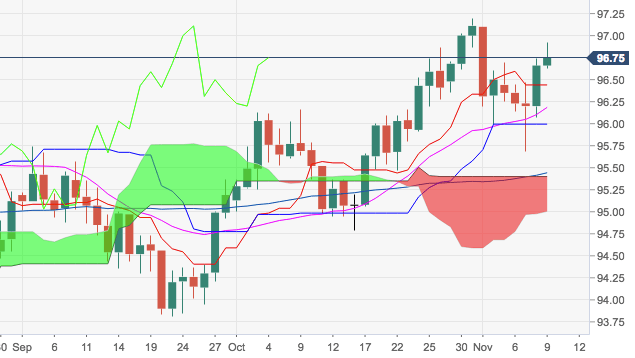

DXY Technical Analysis: The greenback recovers momentum and now targets YTD peaks at 97.20

- The index is extending the strong recovery to the vicinity of the 97.00 area on Friday, moving further up after bottoming out near 95.70 on Wednesday.

- The solid up move in the buck once again opened the door for a potential visit to the 97.00 handle and above, where lies the 2018 peak at 97.19 (October 31).

- Looking at the broader picture, the positive stance bias should remain intact as long as 93.71 underpins (July low).

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.75

Daily change: 9.0 pips

Daily change: 0.0931%

Daily Open: 96.66

Trends:

Daily SMA20: 96.16

Daily SMA50: 95.48

Daily SMA100: 95.24

Daily SMA200: 93.32

Levels:

Daily High: 96.74

Daily Low: 96.07

Weekly High: 97.2

Weekly Low: 95.99

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.48

Daily Fibonacci 61.8%: 96.33

Daily Pivot Point S1: 96.24

Daily Pivot Point S2: 95.82

Daily Pivot Point S3: 95.57

Daily Pivot Point R1: 96.91

Daily Pivot Point R2: 97.16

Daily Pivot Point R3: 97.58