GBP/CHF: Bulls and bears at work at the 1.3100 figure

- GBP/CHF is on a 4-day bull run.

- The Pound is still vulnerable to any news from the EU-UK trade deal

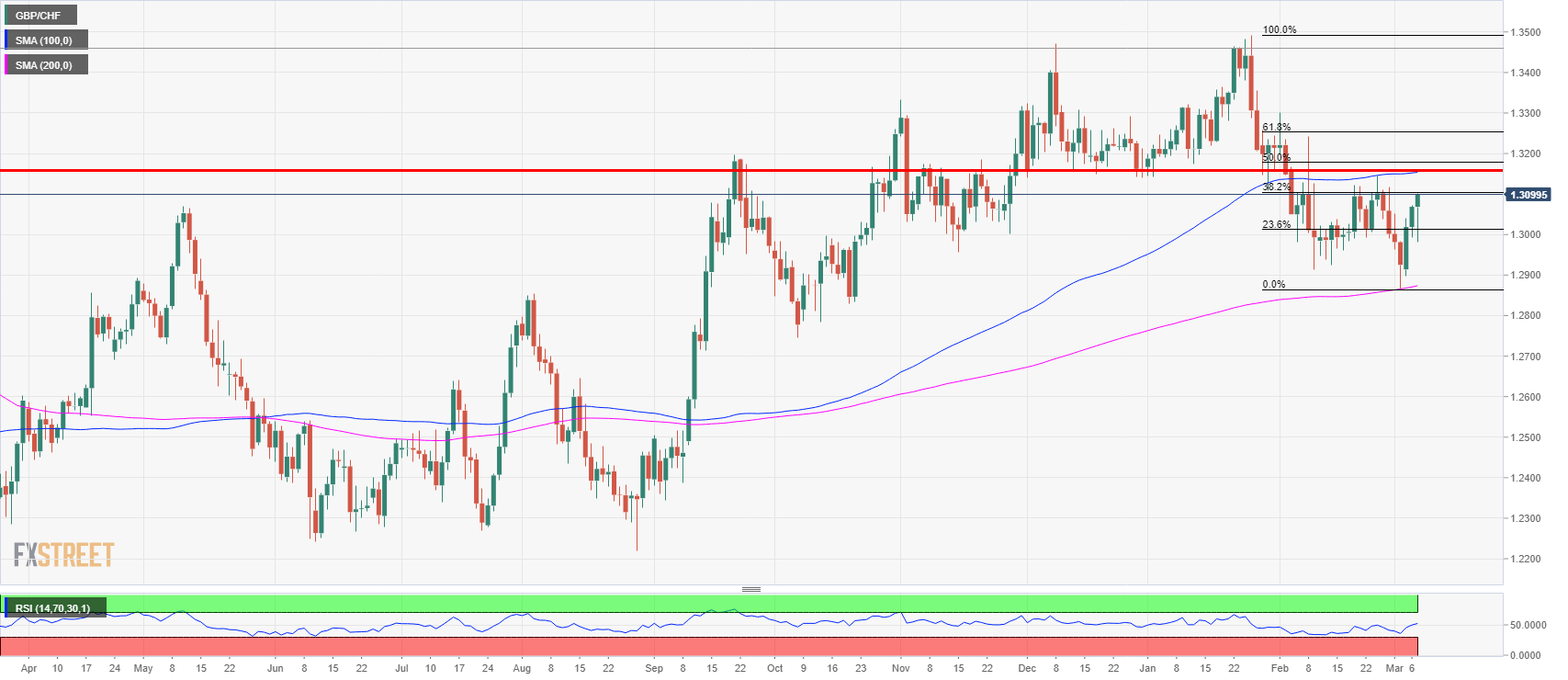

The GBP/CHF is trading around 1.3095 up 0.20% on the day after reversing sharply higher from a low made at 1.2982. The GBP/CHF has been on a bull tear since Friday where it found support at the 200 DMA gaining more than 230 pips in the process. It is now testing the 32.8% Fibonacci retracement at 1.3100 as seen on the daily chart below. If the bulls effort is successful the next resistance is seen at 1.3160 which has been a key supply/demand zone since September 2017. Maybe a positive outcome from the EU-UK trade deal will help the buyers to have the conviction to add capital to their long positions to break the 1.3160 barrier.

GBP/CHF daily chart

Helping the pound to gain against the Swiss franc is the risk on sentiment with North Korea having talks of denuclearization if the international community recognizes its communist regime.

UK macro numbers, coming up on Friday are the industrial production as well as trade data for January. Earlier on Wednesday, Halifax House Prices m/m came in rose to 0.4% vs 0.3% and 1.8% vs 1.6% y/y.

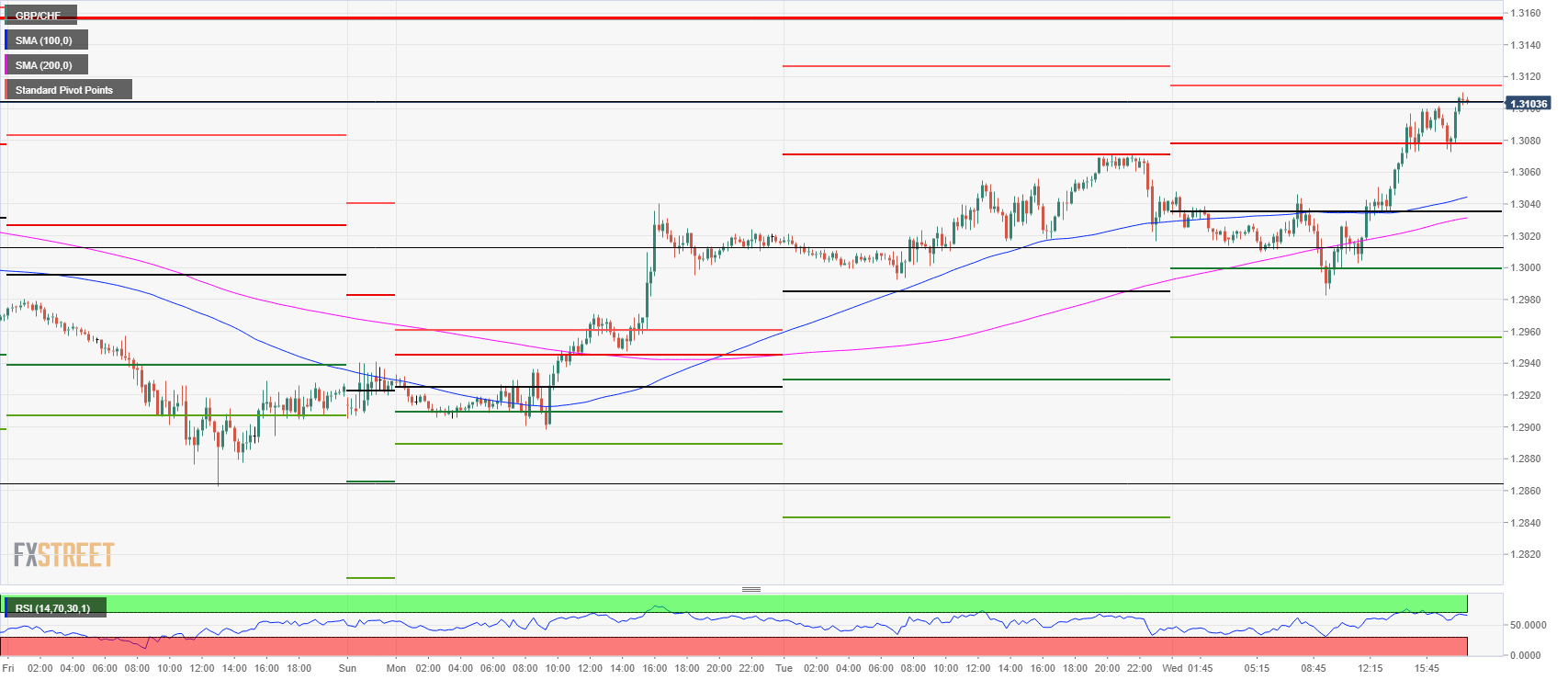

The GBP/CHF is testing the R2 pivot point resistance at 1.3114. If this level is broken the next resistance become the 1.3116 multi-month supply/demand zone. To the downside support is seen at 1.3080 S1 pivot point and further down at 1.3040 daily pivot which is exactly between the 100 and 200 SMA. The price action and the RSI indicator show a bearish divergence.

GBP/CHF 15-minutes chart