Back

30 Jan 2018

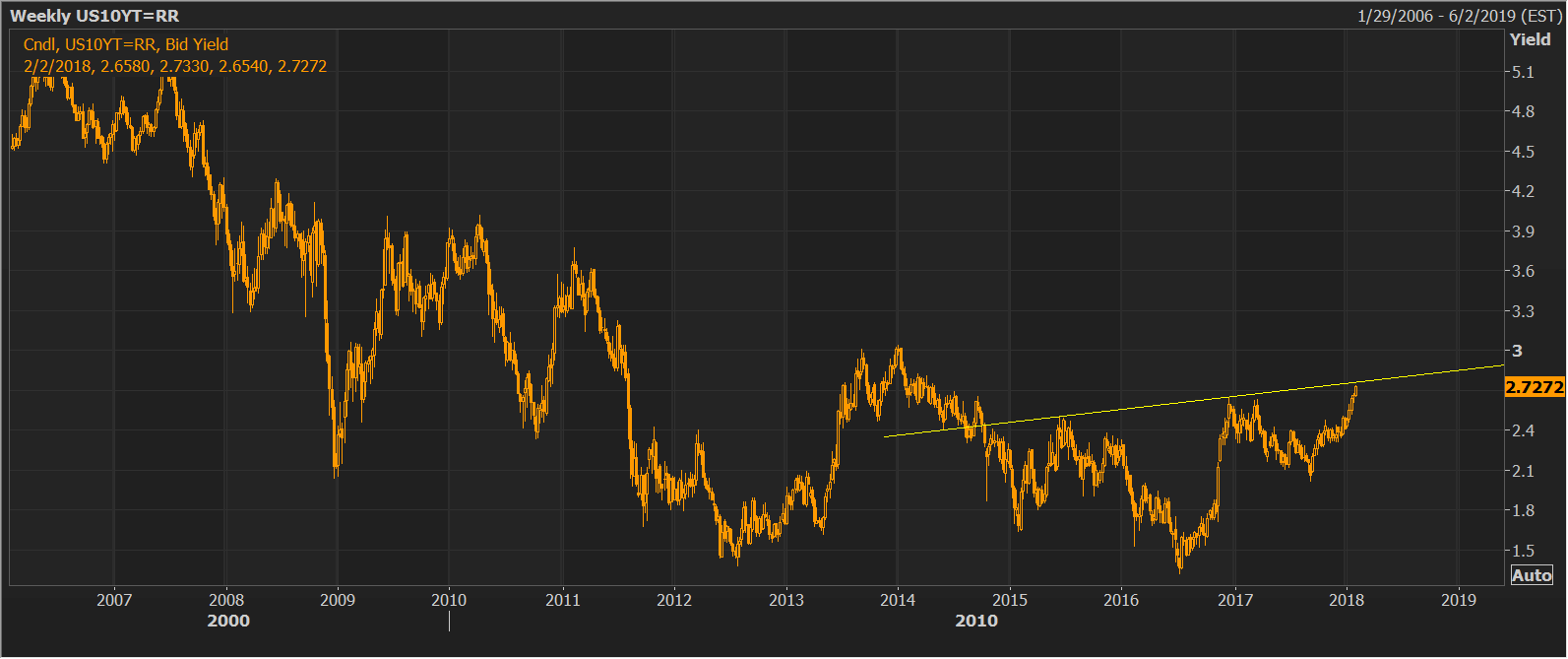

US 10Y T-yield at 45-month high, is the bond bear market here?

- US 10-year treasury yield hit a fresh 45-month high of 2.73%.

- Eyes 2.76% - inverse head and shoulder neckline.

- A long-term bull reversal in yield (bear reversal in bond price) seen above 2.76%.

The US 10-year treasury yield rose to 2.733% in Asia; its highest level since April 2014.

Still, it is too early to call a bond bear market. That said, the yield is fast closing in on 2.76 percent - inverse head and shoulders neckline.

10-year yield weekly chart

- A convincing break above 2.76 percent would confirm the inverse head and shoulders bullish reversal in yields (bearish reversal in bond prices).

- Such a move in yield would signal the end of the 25-year long bond bull market.

- Also, stocks could turn risk-averse following the long-term bullish reversal in yields (bearish reversal in bond prices).