US Dollar is firm in a risk-off start to the week

- US Dollar bulls move in at the start of the week.

- Risk-off themes with China Covid dominates.

The US Dollar moved higher across the board on Friday in what was otherwise a quiet session following the US Thanksgiving holiday.

However, the greenback remained near multi-month lows on the prospect of the Federal Reserve moderating the pace of its policy tightening. With that being said, a risk-off start to the week could come of the protests in China and support the safe havens such as the US Dollar, yen and Treasuries.

Large violent, anti-government anti-lockdown protests have broken out in major Chinese cities. The BBC wrote that videos posted on social media appear to show hundreds of Wuhan residents taking to the streets, with some protesters pictured knocking down barricades and smashing metal gates.

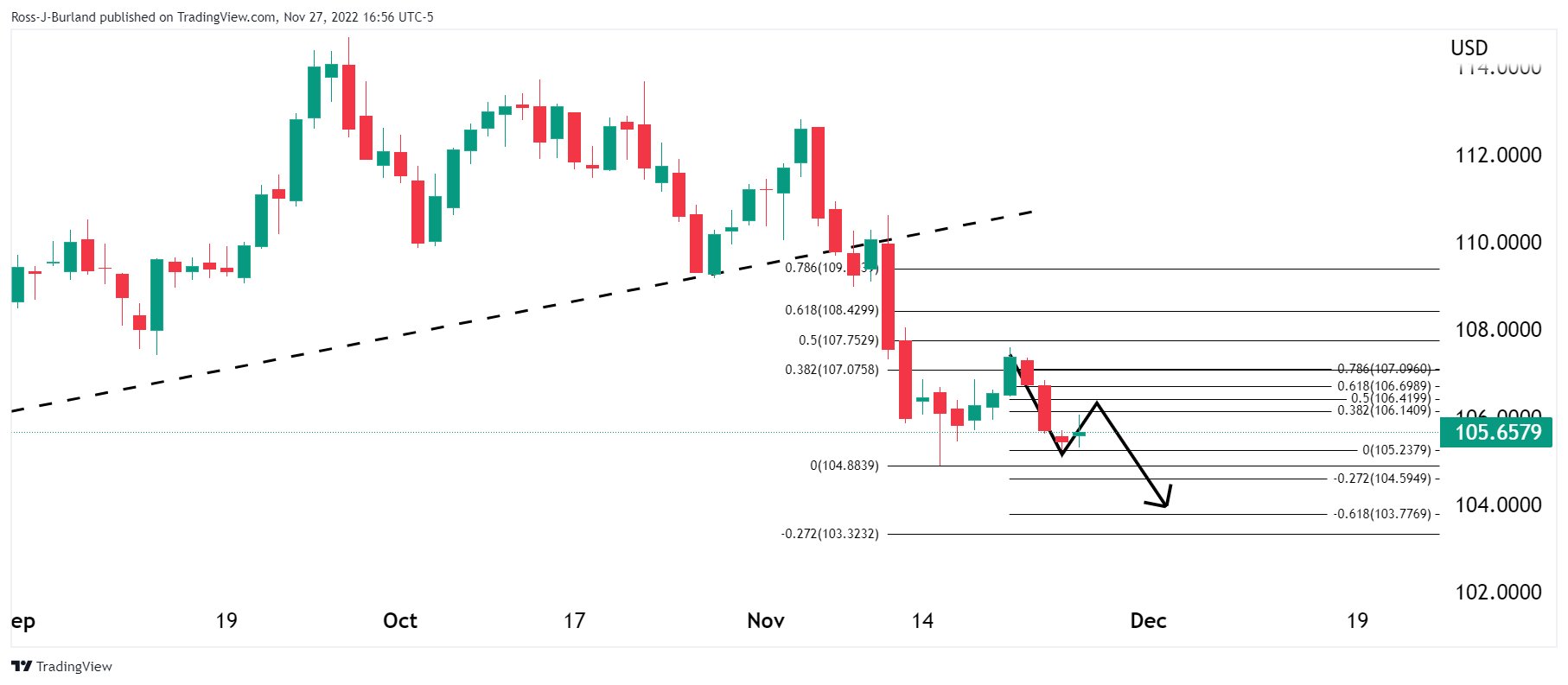

US Dollar technical analysis

On the back side of the bullish trend, this price is making tracks to the downside. However, for the open, a bid in the US Dolar would be expected to see a deeper correction up the Fibonacci scale as follows:

In doing so, the price could be expected to move in towards 106.50 on a break of resistance as per the following hourly chart: